Legal Insights: Your Guide To Expert Law Practices And Advice

Wisconsin Child Custody And Placement: Protecting Your Child’s Future

Child custody and placement are among the most critical aspects of a family law case in Wisconsin. These terms determine where your child will live and how important decisions about their upbringing will be made. Understanding the legal framework and preparing accordingly can help safeguard your child’s future and your […]

The Road To Dissolution: Understanding Minnesota’s Unique Approach To Divorce

Divorce, or “dissolution of marriage,” as referred to in Minnesota, is a legal process that terminates a marriage. It can be emotionally taxing, but understanding the state’s specific approach can alleviate some of the stress associated with the unknown. If you’re in Minnesota and considering dissolution, here’s what you should […]

Dividing The Dairyland: What To Know About Wisconsin Divorce Proceedings

Divorce is a significant life event that brings about emotional and legal changes, impacting families and their futures. In Wisconsin, known for its dairy farms and community values, the divorce process holds unique aspects within its legal framework. Understanding these can empower those facing this transition to navigate the proceedings […]

Navigating Divorce: Key Considerations When Choosing Your Attorney

Divorce, while often necessary, can be one of life’s most grueling challenges. As such, selecting the right divorce attorney is crucial to navigate the complexities of the process, ensuring your rights are protected, and reaching a fair resolution. When starting this search, keep the following considerations in mind: Why Bosshard […]

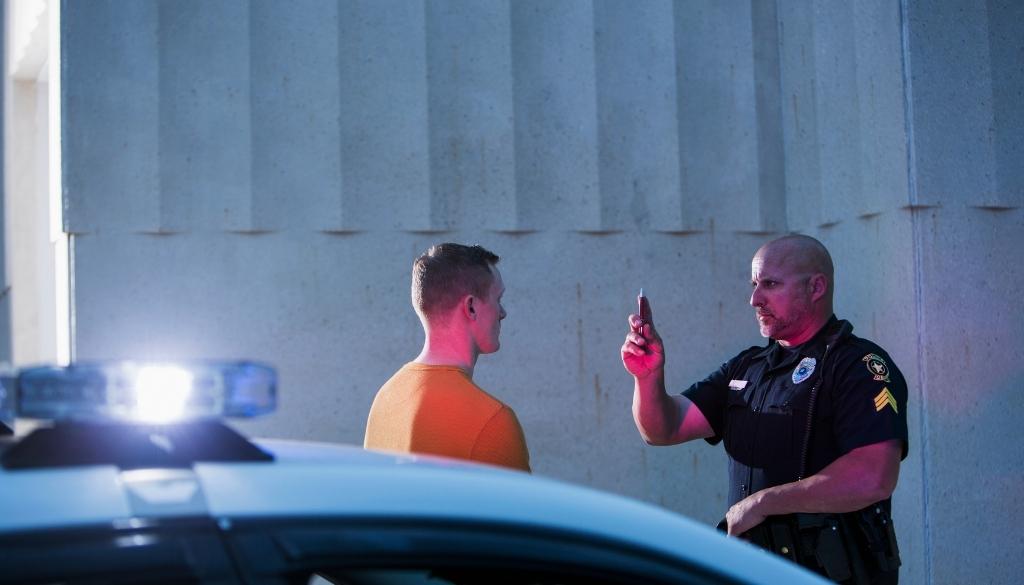

Traffic Stops 101: When Might You Need An Attorney For A Traffic Violation?

It’s an experience many of us dread – the sudden flash of red and blue lights in your rearview mirror. Getting pulled over by law enforcement can be stressful, even if it’s for a minor traffic violation. However, understanding your rights and when you might need an attorney can make […]

Safeguarding Your Child During A Custody Dispute: Essential Steps For Parents

Navigating a child custody dispute can be one of the most challenging experiences a family can face. Amid the legal complexities and emotional turmoil, the well-being of the child should always be the central focus. Parents who prioritize their child’s needs not only promote their child’s emotional health but may […]

What To Look For In An Attorney If Charged With An OWI / DUI In Wisconsin

Being charged with an Operating While Intoxicated (OWI) or Driving Under the Influence (DUI) can be a harrowing experience. For Wisconsin residents and visitors, understanding your rights and securing the best representation is crucial. As you embark on the search for OWI / DUI lawyers, here’s what you need to […]

Estate Conflict Resolution: Expertise And Empathy In Equal Measure

Estate planning, inheritance, and the aftermath of a loved one’s passing often come with a slew of emotions: grief, respect for their legacy, and hope for the future. However, the path forward is not always clear-cut, and disputes may arise that can challenge familial bonds and personal principles. Bosshard Parke […]

The Critical Value Of A Durable Power Of Attorney: Insights From Bosshard Parke

Planning for the unexpected is not just a good idea—it’s an essential step to ensure that your wishes are honored, especially during moments when you may not be in a position to communicate or act on them. One powerful tool in the world of estate planning is the “Durable Power […]